How to apply IPO through SBI bank?

Invest brokerage-free Equity Delivery and Direct Mutual Funds (truly no brokerage). Pay flat Rs 20 per trade for Intra-day and F&O. Open Instant Account and start trading today.

State Bank of India (SBI) offers an online IPO application through its net-banking website and Yono Mobile app. SBI bank account holders who have access to net banking can apply for an IPO in just a few minutes.

While applying in an IPO using SBI Net banking, cusotmer could choose Demat account with SBI or any other stock borker. Customer has to select the DP (CDSL or NSDL) and enter the demat account number in the IPO application.

Note:

- SBI doesn't offer a 3rd Party IPO Application from 1st May 2022.

- Both Mainboard and SME IPOs are available.

- The customer could choose ASBA or UPI as a payment option.

- Demat account with any broker can be used while applying IPO.

Prerequisites for SBI online IPO Application

- The net-banking facility should be enabled.

- The IPO applicant's PAN number in demat and bank account (primary account holder) should be the same.

- Minor below 10 years cannot apply in IPO online as they don't have access to net banking. They only way to apply in this case is by filling paper IPO application form.

- Minor from 10 to 15 years can apply using ASBA facility offered by SBI.

- Minor above 15 can apply using UPI as well as ASBA.

Steps to online IPO application through SBI bank

The process to apply for an IPO through SBI internet banking involves following 6 steps-

- Login to your SBI online account

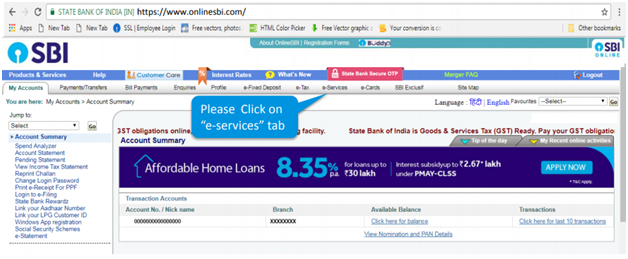

- Click on e-Services Tab

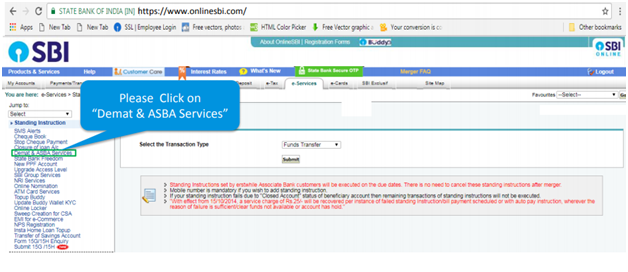

- Now click on 'Demat and ASBA services'

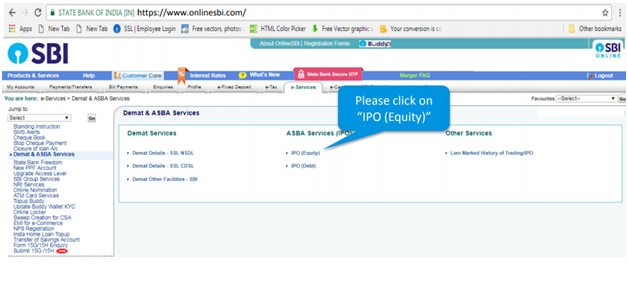

- Click on 'IPO Equity'

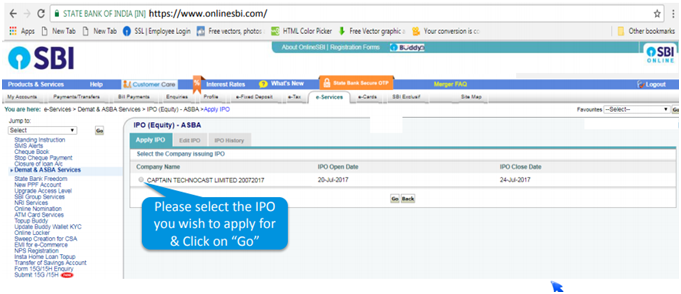

- Select the IPO you wish to apply from the list

- Enter IPO details

- Verify and Confirm the details

Details of ASBA application from SBI Bank

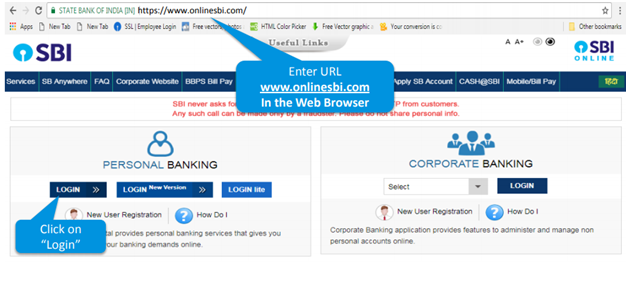

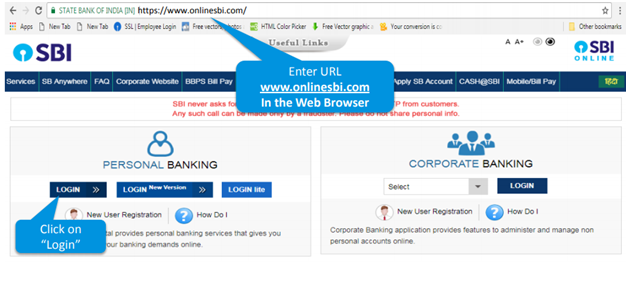

- Login to your SBI online account Enterwww.onlinesbi.com URL in your web browser. On the website, click on login on the personal banking section.

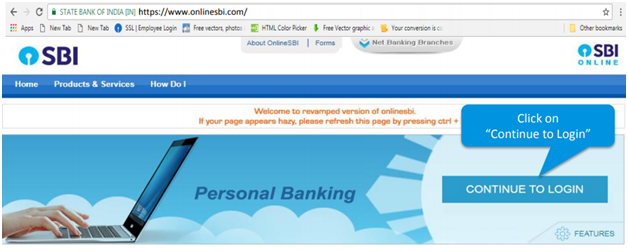

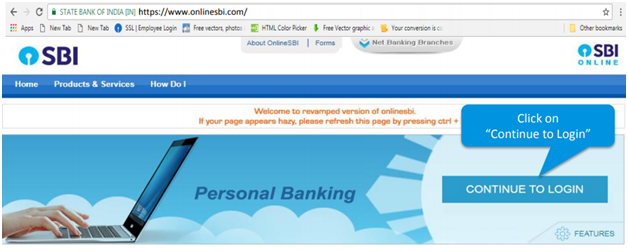

On the personal banking page click on 'Continue to login'

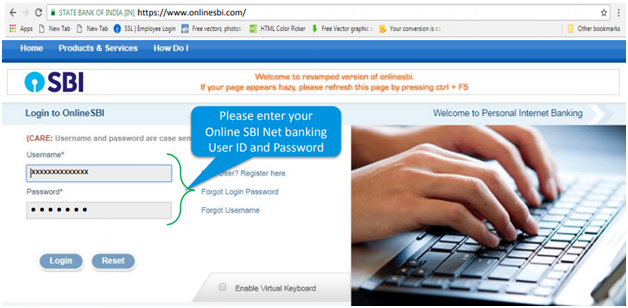

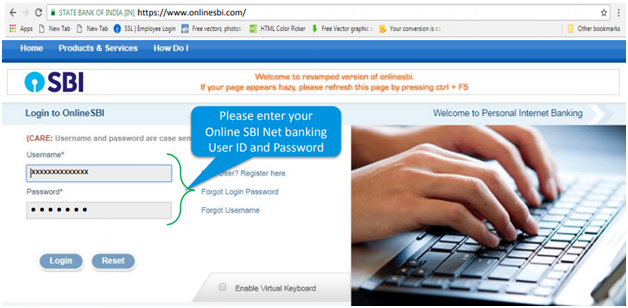

On the personal banking page click on 'Continue to login'  On the login page, enter you netbanking User ID and Password

On the login page, enter you netbanking User ID and Password

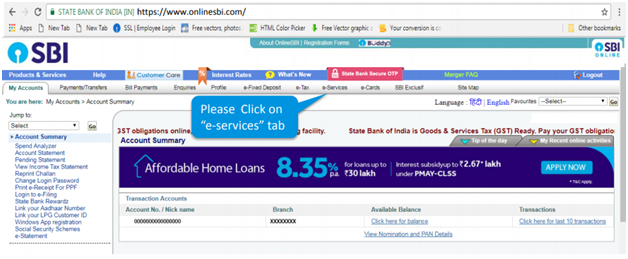

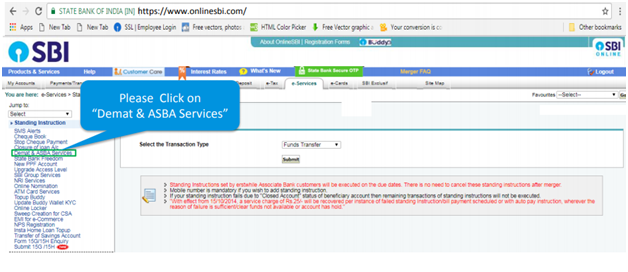

- Click on e-Services Tab In your accounts page, click on the 'e-services' tab

- Click on 'Demat and ASBA services' Now click on 'Demat and ASBA services' in the menu appearing on left side of your screen.

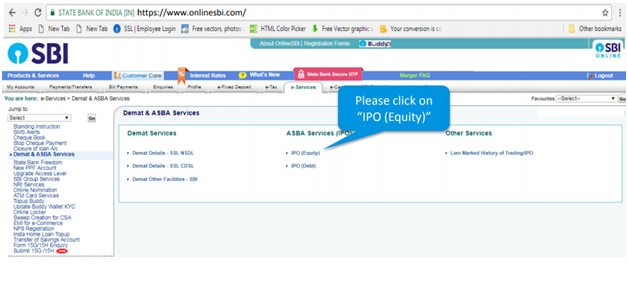

- Click on 'IPO Equity' On the 'Demat & ASBA Services' page, you will be presented with 3 sections- Demat Services, ASBA Services and Other Services. Under the 'ASBA Services', click on 'IPO Equity' and click on 'Accept' after reading the terms and conditions.

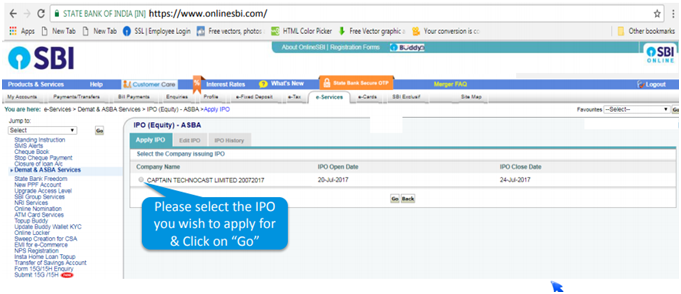

- Now select the IPO you wish to apply from the list The IPO Equity-ASBA page will provide you with a list of companies issuing IPO at that time with open and closing date of bidding. Select the IPO you wish to apply and click on 'Accept'.

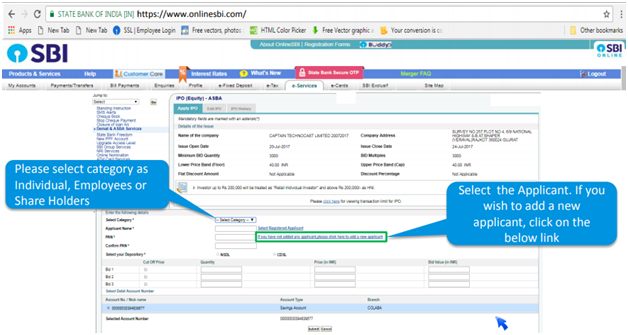

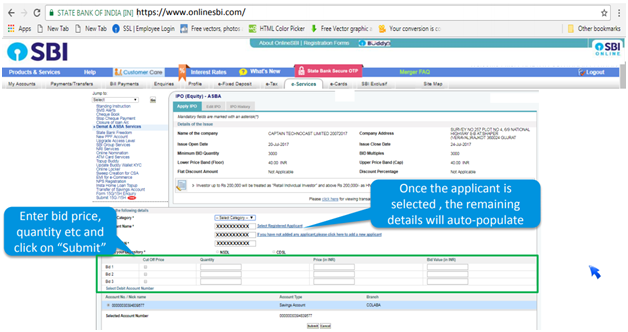

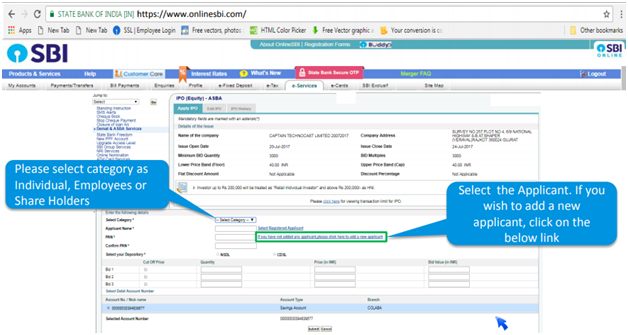

- Enter IPO Details The IPO page will have details on the IPO like minimum bidding quantity, price of each share, IPO open and closing date etc. It will also have a form wherein you need to enter applicant and IPO details.

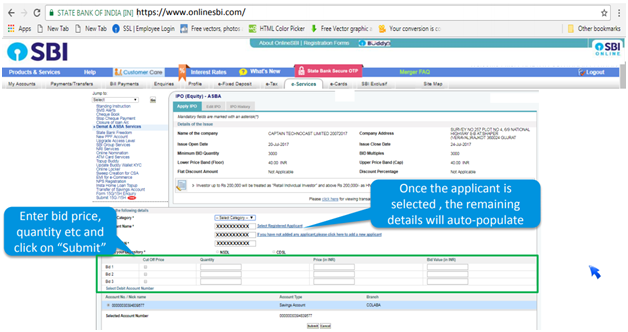

The first detail you need to enter is category. You need to choose from individual, employees or shareholders. The second detail to enter is the applicant. If you have added yourself as an applicant then select applicant name. Once the applicant is selected, other details like PAN and depository name will be automatically populated or filled. Enter other IPO details like quantity, bid price etc. There is also a checkbox for 'cut-off' price. This option is available for retail investors and is useful in book building issues where instead of a fixed price, a price range is provided by the company. Investors have to bid within the range. Ticking on 'Cut-off price' means that you approve to accept the allotment at the price decided by the company. This saves you from the bidding race and ensures that you don't lose on allotment due to lower bidding price. Enter the details and click on 'submit'.

The first detail you need to enter is category. You need to choose from individual, employees or shareholders. The second detail to enter is the applicant. If you have added yourself as an applicant then select applicant name. Once the applicant is selected, other details like PAN and depository name will be automatically populated or filled. Enter other IPO details like quantity, bid price etc. There is also a checkbox for 'cut-off' price. This option is available for retail investors and is useful in book building issues where instead of a fixed price, a price range is provided by the company. Investors have to bid within the range. Ticking on 'Cut-off price' means that you approve to accept the allotment at the price decided by the company. This saves you from the bidding race and ensures that you don't lose on allotment due to lower bidding price. Enter the details and click on 'submit'.  Once you click on the submit, you will be taken to the 'IPO Confirmation Page'. This page will have the list of IPOs successfully applied. Check for the 'Name of the Company' you applied for, Lien Marked Amount and Lien Marked Status. If all details are OK then you have successfully applied for the IPO. Eligibility- Who can apply for an IPO online through SBI Bank netbanking? You can apply for an IPO through SBI, if you-

Once you click on the submit, you will be taken to the 'IPO Confirmation Page'. This page will have the list of IPOs successfully applied. Check for the 'Name of the Company' you applied for, Lien Marked Amount and Lien Marked Status. If all details are OK then you have successfully applied for the IPO. Eligibility- Who can apply for an IPO online through SBI Bank netbanking? You can apply for an IPO through SBI, if you-

- Are above the age of 18 years

- Are a savings or a current account holder in the bank

- Hold single or joint account with the bank

- Have a demat account with NSDL or CDSL

- Have Permanent Account Number (PAN)

- Have funds more than the application amount in the account

Zerodha (India's Best & No. 1 Broker)

Special Offer - Free Equity Delivery and Mutual Funds

- Brokerage-free equity delivery trades.

- Brokerage-free Direct Mutual Fund.

- Pay ₹20 per trade for Intraday & F&O.

- The best trading platform in India.

On the personal banking page click on 'Continue to login'

On the personal banking page click on 'Continue to login'  On the login page, enter you netbanking User ID and Password

On the login page, enter you netbanking User ID and Password

The first detail you need to enter is category. You need to choose from individual, employees or shareholders. The second detail to enter is the applicant. If you have added yourself as an applicant then select applicant name. Once the applicant is selected, other details like PAN and depository name will be automatically populated or filled. Enter other IPO details like quantity, bid price etc. There is also a checkbox for 'cut-off' price. This option is available for retail investors and is useful in book building issues where instead of a fixed price, a price range is provided by the company. Investors have to bid within the range. Ticking on 'Cut-off price' means that you approve to accept the allotment at the price decided by the company. This saves you from the bidding race and ensures that you don't lose on allotment due to lower bidding price. Enter the details and click on 'submit'.

The first detail you need to enter is category. You need to choose from individual, employees or shareholders. The second detail to enter is the applicant. If you have added yourself as an applicant then select applicant name. Once the applicant is selected, other details like PAN and depository name will be automatically populated or filled. Enter other IPO details like quantity, bid price etc. There is also a checkbox for 'cut-off' price. This option is available for retail investors and is useful in book building issues where instead of a fixed price, a price range is provided by the company. Investors have to bid within the range. Ticking on 'Cut-off price' means that you approve to accept the allotment at the price decided by the company. This saves you from the bidding race and ensures that you don't lose on allotment due to lower bidding price. Enter the details and click on 'submit'.  Once you click on the submit, you will be taken to the 'IPO Confirmation Page'. This page will have the list of IPOs successfully applied. Check for the 'Name of the Company' you applied for, Lien Marked Amount and Lien Marked Status. If all details are OK then you have successfully applied for the IPO. Eligibility- Who can apply for an IPO online through SBI Bank netbanking? You can apply for an IPO through SBI, if you-

Once you click on the submit, you will be taken to the 'IPO Confirmation Page'. This page will have the list of IPOs successfully applied. Check for the 'Name of the Company' you applied for, Lien Marked Amount and Lien Marked Status. If all details are OK then you have successfully applied for the IPO. Eligibility- Who can apply for an IPO online through SBI Bank netbanking? You can apply for an IPO through SBI, if you-