The era of digital advancement we live in these days does not find all the industries equally well. Being highly dependent on technology, the financial and banking industry is frequently forced to deprive its operations of innovation in the favor of stable performance expected by users. Is there a way out for banks and other financial entities stuck with outdated software solutions? Yes, and it is called software quality assurance for banking. How can banks achieve high-tech progress without compromising the continuous crash-free consumer service through software testing? Answered in today’s guide to banking application testing.

The reason why we are talking about the peculiarities of testing banking software in the first place is that this type of application possesses a unique set of traits that require a singular approach to testing. Here are the main characteristics of a banking solution that make it stand out:

We don’t need to tell you how different banking apps are from many other software products. When dealing with something as sensitive as payment details, the approach to development and testing should be top-notch. Moreover, the architecture of these apps is nothing like it is in most other apps. It comprises four tiers, including a server with the logic of the app, a database for storing user data, a payment processor for handling financial transactions, and a client interface that keeps all the elements together, facilitating user inputs.

With an architecture as complex as this, QA departments need to be particularly careful and have an in-depth understanding of the domain to navigate the challenges common for testing banking apps. What are these challenges and how do they impact the way banking testing is carried out? Let’s look at them more closely:

As we’ve mentioned, banking apps have a rather complex architecture. This comes from the fact that banking procedures entail elaborate business workflows consisting of multiple stages. To understand what we mean, let’s take the procedure of opening a bank account as an example. A seemingly simple operation, it requires a lot of steps. First, the client needs to send a request to the bank. The bank, in turn, must validate the data, verify the client’s ID, record customer information, and see what deposit service to offer. Then, based on the collected information, it should prepare the docs and propose account opening. Now, this is only half the journey of what happens behind the scene.

Once the client proceeds with the account, it must be further validated and activated. Depending on the selected actions, the account will either be recorded or extended further if any additional steps are required, such as setting additional security measures or verifying specific documents in case of large deposits. In all of this, the tester’s role is to ensure the seamless functionality of each stage and confirm the uninterrupted progress of the workflow, which requires deep understanding of the banking processes.

Another common challenge in testing financial applications is to ensure that they can effectively deal with vast amounts of transactions. Imagine a bank of the size like JPMorgan Chase , the biggest bank in the world. It has over 33 million active mobile users and handles at least 49 million transactions daily, which is a staggering volume of data being moved through its systems.

Now, what would happen if all of a sudden all those people couldn’t get access to their own money because of a sudden spike in user load? That’s right, a disaster. Therefore, performance and load testing becomes crucial.

That said, even if the app doesn’t have as many users, it’s essential to prepare it for scalability by flooding it with sudden increases and decreases in user activity. Market movements can trigger a surge in user transactions at any moment, and it’s important that the app can deal with it effectively not to lose the trust of its users.

A banking application encompasses so much more than just account information. Now with just one app, people can conveniently manage their finances, transfer money to other accounts, and pay for things online, whether it be utility bills, a purchase order, parking, or anything along those lines. All of this has become possible thanks to third-party integrations. However, as much as these integrations have simplified the lives for regular users, they’ve made the life of QA testers much more difficult.

Oftentimes, when an app is integrated with a new service, the service comes with its own database, and that database needs to be synced with existing systems, requiring lots of manual work. Testers not only need to go through the database carefully, ensuring that its data is viable and the format is correct, but also validate the security measures to exclude the risk of data breaches and cyber attacks. The integration itself should be carried out with precision to ensure seamless communication between the banking app and the third-party service, which involves extensive API testing .

Speaking of the challenges, the diversity of devices people use today to access their banking information adds a layer of complexity to the testing process. Not only are there plenty of manufacturers producing all sorts of smartphones and tablets, but these gadgets are also updated every month or two, which means that, on top of an array of devices, testers have lots of operating systems to test before launching a banking application.

This can be a huge hurdle for testing teams that don’t have extensive device coverage. Sure, they may use simulators and emulators – in fact, they may come in particularly helpful in the case of very old or rare devices – but the value of physical devices cannot be overstated! By testing an app across multiple physical devices with different screen sizes, resolutions, and hardware specifications, testers can ensure glitchless experience for users and make the app universally accessible.

Banking applications are one of the fastest growing tech sectors, which requires product owners to race against the clock to make sure their product or application is released ahead of the competitors. As a result, companies in pursuit not to lose their leading positions often have to speed up the bank application testing process, skipping important steps or the final stage of testing altogether. The outcome can be easily guessed. Rushing through the testing can lead to multiple issues, from minor bugs and glitches that may hinder user experience and lead to overall dissatisfaction among users to serious security vulnerabilities that put sensitive financial information at risk.

Internet connection speed and stability varies greatly depending on the location, but users will expect different modules of a banking solution to be accessible at all times regardless of the connection status. This is why, with banking apps, network testing is done to ensure the availability of the solution regardless of the corresponding variables in the application.

Need help with banking software testing? We are here for you! Get in touchWhat are you building? What kind of help can we provide? The more we know, the more accurate our estimate!

Thank you for taking the first step! We’ll get back to you within 2 business days!

It’s interesting to look at some of the examples of errors and bugs that may occur when testing banking applications. Drawing on the experience of other companies, you can avoid many mishaps and ensure that your solution is released to the public bug-free and ready to use.

Why type all those characters if a single emoji does the trick? If you didn’t skip over the title of this section, you’ll know why.

In May 2016 , a client of a certain bank decided to use emojis to name their savings accounts: 💸 instead of “Tax Money” or 🏠 for “Mortgage”. While the client was enjoying the new, concise, and cute name in the banking application, the bank itself experienced the system crash. After investigating everything that could potentially affect the performance of their CRM software, the technical support team found out that it was the emoji that their system couldn’t recognize. After changing the account name, the team was able to get the CRM back on track again.

A thorough examination of this issue showed that financial applications aren’t the only type of software that can break because of emoji figures. Putting them in the names of your Wi-Fi network or Bluetooth device can reportedly cause problems when connecting to these interfaces. This is because the character encoding standards that most software systems rely on were created way before people knew what emojis are. So, if not tested in advance and extended intentionally, representational systems like ASCII (American Standard Code for Information Interchange) and EBCDIC (Extended Binary Coded Decimal Interchange Code) won’t support funny faces or even diacritical marks such as ë or é.

It’s hard to imagine that in the time when people just won’t stop talking about all the amazing benefits of artificial intelligence and machine learning, some industries can actually deteriorate when adopting them.

Initially, AI and its applications for banking were aimed at making credit risk assessment faster and less biased by decreasing the level of human involvement. But as practice has shown, AI is influenced by the information it is fed, and the bias that was meant to be expelled from the system becomes part of the AI’s decisions. For example, the FICO score system which is used to measure consumer credit risk across the United States continuously works towards making the scoring process more transparent and gender- and race-neutral. However, given that artificial intelligence algorithms do not differentiate the discriminatory factors from fair-minded ones, the correlations they produce inevitably include the information about ethnicity, gender, social group, etc.

Furthermore, there are also many small details like grocery preferences and music taste that end up in the AI-powered credit score analysis. All that is really fascinating, but the real question is, do we really need all that information to make the right lending decision? Finance practitioners admit that ML and AI applications for credit scoring rather create bias than help to prevent it.

Another issue the banking industry has with AI is the lack of explainability. All consumers who weren’t approved for loan, have the right to get an extensive explanation of the refusal. This information is nearly impossible to gather because of the unknown patterns a machine learning model follows to analyze consumer data. While making the rating procedure faster for credit managers, AI decreases its transparency for end users, thereby affecting the level of trust to financial institutions in general.

Surprisingly to many, large powerful corporations are no stranger to software glitches. Namely, one of the largest financial companies in the world HSBC has experienced difficulties keeping its mobile application live numerous times. For example, in November of 2018 , HSBC mobile app crashed during Black Friday ― the largest global sales of the year. Thousands of people were unable to enter their accounts, therefore could not take advantage of the limited-time offers from online shops. Poorly functioning apps are always irritating, but when it comes to a program that enables you access to your own money, mild frustration can turn into righteous fury really fast.

There could be many reasons why banking software might fail, but when this happens during the long anticipated sales (as with HSBC), we can surely tell the application just couldn’t stand the user load. Such events will always be a challenge for banks due to the wave of transactions, so in our humble opinion, this is something the HSBC online-banking test team should have foreseen. Both stress and load are rather unexpected issues, yet they can (and should) be planned and assessed by R&D teams. The corporation prefers not to publicly discuss other reasons why their app eventually stops working, as opposed to their users, who were very vocal on social media when it came to complaining on application performance.

The aforementioned software errors made their way to the news, yet this doesn’t mean character recognition, load stability, and control over AI extensions are the only things you have to think of when testing your banking application. There are thousands of less headline-worthy bugs that happen in finance software daily, and only a thoroughly planned and well executed QA process can help your business deal with each of them in advance. That being said, we’re moving to more aspects to consider when working on a banking application.

Are you sure your application doesn’t hide anything from you? Let us find out and fix it immediately!

What are you building? What kind of help can we provide? The more we know, the more accurate our estimate!

Thank you for taking the first step! We’ll get back to you within 2 business days!

The process of testing banking applications is very important given the level of responsibility that banks bear, but before moving to this stage, there are a few more things to consider.

The more complicated an app’s functionality is, the more complex and layered the testing process of it is going to be. That’s why you definitely need to choose the right testing management platform to maintain all the controls over your QA activities in one place. Namely, through a testing platform you and your QA team will be able to:

With banking and financial programs especially, this choice has to be well thought out. This is because such software solutions are very feature-rich and therefore have a complex architecture. To organize the testing process, you’ll have to use multiple tools, environments, and devices, which means it would be better to select a testing platform that can cover multiple activities and integrate with many other programs at once. Every time our team has to find a matching test management platform for a new project, we weigh up the following factors beforehand:

If you don’t have much experience comparing the different QA management tools, here are a few that we recommend checking out as your starting point for further comparison:

No matter what software testing platform you’re going to choose for your project, banking and finance application testing is impossible to keep productive without one. By maintaining accurate project planning, linking different experts and teams together, and tracking the progress, a test management system basically becomes an integral part of your QA operations.

They say a good plan makes the job half-done, and we couldn’t agree more, especially in the context of software testing for banking. The BFSI industry highly depends on IT, which creates pressure for software owners to keep up with the emerging tech trends so that their digital products would remain concurrent and interesting in the eyes of consumers. And while there’s no doubt in the importance of continuous digital transformation of banking applications, many product owners do not realize that unless you have planned for software scalability, it’s going to be extremely difficult to transform in the future.

Software scalability is the ability of a system to extend its functionality and capacity when needed. In other words, a scalable application allows software engineers to add new features to the existing codebase instead of starting over the development process only because they need some extra functions on board. Unfortunately, scalability is only achievable if planned early and implemented in the codebase on the architectural level. But how to find out if your banking application is going to be technically scalable? Of course, through early banking app testing.

Involving QA engineers to work on complicated projects like finance software as early as you can always pays back with better performance and saved resources. Usually, when people think of how to test banking applications, they imagine the process to follow as “develop first, test later”.

In reality though, if you want to end up with a future-proof digital solution with enough room for new functionality when needed, we strongly recommend adding prototype and requirements testing to your QA scope. By gathering expert opinions about what is planned to be built, you will be able to predict potential bottlenecks on the paper rather than urgently fix them before the release. With such a sensitive sector as finance management, early testing ensures a strong brand reputation and unwavering consumer trust.

Financial institutions are generally prone to bureaucracy that oftentimes holds them back from technological advancement. The thing is, in order to keep their internal operations running as safely as possible, banks and insurance entities cannot adopt IT change fast. That’s why the vast majority of modern banks are stuck with legacy operating systems and mainframe technologies that are just too huge and puzzling to transform, which may create additional challenges when you test banking domain applications. Generally, there’s nothing too bad about legacy systems as long as they work as required. But once you stumble across an emergency or just a new technology invented that your bank just can’t ignore, the legacy and mainframe systems might put at risk the functioning (if not the whole existence) of a bank.

A vivid example of such an emergency is the infamous COBOL crisis of 2020 . In short, after the pandemic hit the fan, numerous US government departments experienced a huge increase in online unemployment claims. There were so many, that the mainframe system to process them simply could not stand the load. That mainframe system was based on COBOL (Common Business Oriented Language) ― a programming language created and widely used in the 1960s. It is outdated to the point that the majority of COBOL talent pool is now in their 70s, and the state had to ask for help from retired programmers to put the software back on track. It worked this time, luckily, but as the time goes by, next time there might be no such option available.

Is there a solution for finance establishments dependent on their legacy applications? We believe there is, even though the transformation path for such enterprises won’t be the easiest. If you don’t want to realize one day that your operating system is just a pile of fossils, we recommend you to set a solid QA process before the need for change actually comes into play. Again, the earlier software quality experts enter your SDLC, the less inaccuracies will make it to the end product. No digital product will benefit from QA supervision more than a large legacy solution that’s been developed for years. In this case, the duties of the software testing department are shifting to the strategic planning, code analysis, and prototyping from the usual pre-release testing, which is in fact just a small part of what quality assurance teams actually do.

Banking application testing has a number of unique requirements that come from the critical nature of financial services, the high standards for reliability and security, and the extensive regulatory compliance demands. Further down, we’ll explore what the BFSI domain means and look at the key peculiarities of banking domain testing.

BFSI domain testing is a set of activities executed by software testing engineers to assure a banking application meets the technical requirements and works smoothly. Any operation aimed at achieving the higher software quality or fixing a glitch in a finance-related digital product falls into the BFSI domain testing. This means, the objectives for such an operation have to be aligned with the most important characteristics of a banking application. You may also consider adding a domain expert to your QA team to ensure that the application gets the best possible treatment.

Banking software testing is not much different from any other type of quality assurance: it is still intended to check if the program works as expected and has no hidden bottlenecks drawing its potential back. However, the peculiarities of BFSI as an industry, namely ― data confidentiality and extreme sensitivity to thieving, make software development and testing teams shift their focus to particular areas that might not get as much attention with different types of software.

Financial applications directly interact with user confidential information and basically have all the keys to one’s capital, which means there is nothing more important than security for a banking app. QA engineers should devote proportionally more time to test the application for security, as well as include both negative and positive test scenarios of the app’s database being attacked. Only after the testing team can call the application fully hack-proof can it be considered market-ready (given that you got all the other aspects like performance and UI/UX covered as well).

Banking and finance sector has a huge share in IT services consumption, meaning there are millions of people who use at least one banking app on a daily basis. Understanding that not all users have equally strong technical skills, programs targeted at such a wide audience have to be very efficient and straightforward to be accepted by people. Make sure your banking app allows users to get things done fast and easy.

The industry for which the software is created has more influence on the end product than many of us think. Different industries are run by different rules, and banking is no exception. It has its own terms, customs, and procedures which can cause confusion if not followed. Domain knowledge is important for developing finance or banking software, where product owners have to make sure the way their apps look and work corresponds to the generally accepted standards for both professionals and consumers. We recommend seeking domain-specific expertise for at least some roles in your R&D team. Ideally, the testing team you’re hiring has already worked with products targeted to the same industry, regardless of the app’s type and tech stack.

As we already explained above, unscalable applications sooner or later will pull the rug out from under your business. This is why we can’t stress enough how important it is to keep the application’s architecture scalable and leave room for potential functionality growth since the very start. The QA team has to keep an eye on the app’s tech stack to pick modern technologies that will not lose its relevance in a few years and further, code implementation which has to be clear and reusable, and product structure to make sure it can increase in capacity without breaking down what’s already working. To test how scalable your application is going to be, a ton of tiny details have to be analyzed, from the app’s data processing algorithms to file system and memory management.

As the World Health Organization reports, about a billion people in the world have at least one limitation ― physical or mental ― that affects their ability to use technology and software. This inspired software developers to pursue a higher level of accessibility for digital products. Considering how wide and diverse the target market of banking apps is, the accessibility issue should definitely be among the top priorities for owners of such products.

With close to 7 billion smartphones operated currently around the world and 212.8 million mobile banking users in the US alone, the mobile user segment is one that banks and financial institutions can no longer afford to ignore. Users expect to be able to access their bank account information and perform transactions at any time of the day while not having to worry about their sensitive information’s security.

This is why testing on mobile devices is just as important as testing on desktop platforms. That also involves comprehensive compatibility testing, as there are hundreds of smartphones out there and they all have their hardware and software peculiarities. This type of testing should ideally be performed on real devices, as there are many usability and user experience-related aspects of using an application that device emulators cannot replicate just yet.

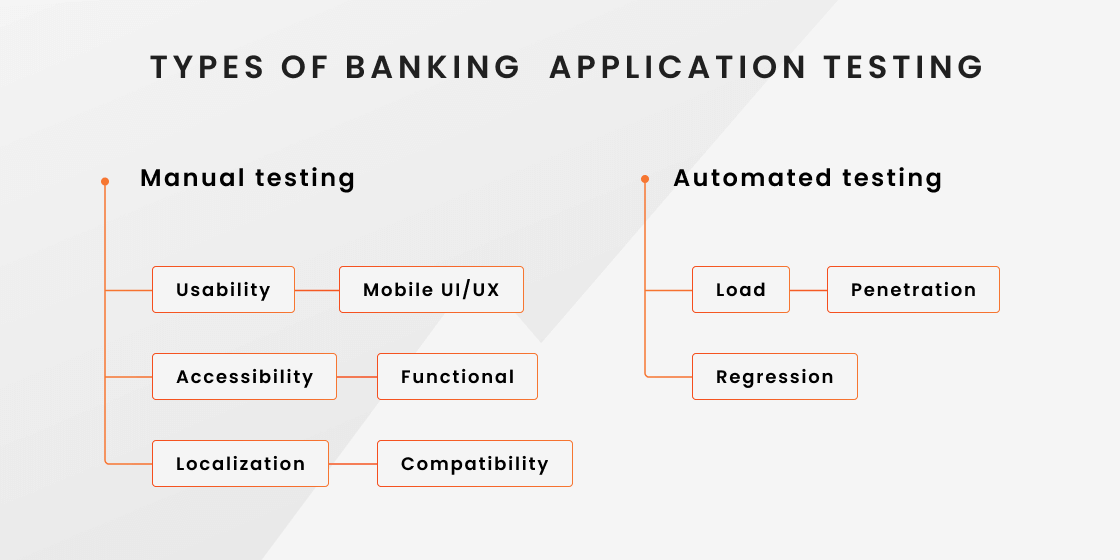

Banking applications are typically tested manually and automatically, using a range of testing types to ensure thorough coverage and address the unique challenges of the banking sector. Here’s a deeper look into the key types of banking domain application testing.

Manual banking application testing implies that a quality assurance engineer executes certain test case scenarios by hand. This allows the development team to evaluate the product from human perspective and improve the subjective side of the application, intuitivity and aesthetics included.

Usability testing is pretty self-explanatory ― it examines how easy and comfortable it is to use a mobile or web application for different people. Usually, the process of usability testing consists of executing typical test scenarios the app was created for and documenting the issues representative users or manual testers stumble across during the execution, especially ones that are related to UI/UX design. The test cases should be realistic, like booking a flight for a customer-facing airport CRM or tracking an order for an online shop. Test case for banking application in this context could vary as follows:

Due to its sensory and technical peculiarities, mobile application testing differs a lot from desktop and web programs. Mobile banking testing is mostly centered on UI/UX because the basic functionality of such applications are not the easiest to reflect on a small screen. Furthermore, these days users want to be able to do anything on the go without compromising the safety of their personal information, which is another challenge to mitigate for UI/UX designers and testers. Test case scenarios for mobile UI/UX usually include:

To achieve accessibility with your application, you need to incorporate and thoroughly test such features as font size customization, one-hand operation mode, screen reader, colorblind screen filter, etc. Testing of such features can be tricky since it’s only people living with a certain limitation who can tell if the app is doing a good job. If possible, we’d recommend considering a focus group for accessibility testing or at least launching a beta to gather the feedback and implement the necessary changes. Specifically for the finance and banking apps, we suggest the following addings to make your product more accessible:

A typical banking application has a wide range of features, and the job of the testing team is to make sure they are all present and operate properly in the release version of the product. Functionality testing means a QA engineer defines the core functions of an application and then tests them one by one in different scenarios. Composing a testing scenario is an integral part of a QA’s job. The output received after the test cases execution gets compared to what was expected and fixed if needed. Bank software functional testing helps engineers focus on the following:

The purpose of localization is to ensure that the content displayed in the application fits the region it is intended to launch in. Due to the cultural differences across countries, the look of the app at times requires drastic changes. Localization testing also ensures that the application complies with local laws and regulations, so it usually goes deeper than just language and timezone settings. Online-banking tests for localization include:

Compatibility testing stands for the analysis of how your application works with different operating systems, network environments, and hardware models. Nowadays, this is a very important type of testing due to the fact that the IT industry develops at a very fast pace. Versions of operating systems change one another every year, let alone the minor updates we all receive on our gadgets regularly without even noticing this anymore. However, even the slightest technical change like another Android security patch can interfere with the functioning of your app. To test the compatibility of a banking application, software testers usually focus on these specifications:

Automated testing is a method of software quality assurance that implies test cases execution with the use of automated testing tools, as opposed to manual testing. To enable testing automation, the team has to come up with the expected outcome for each test case that a program will then compare to the real result received after the execution. This method of quality assurance perfectly suits routine and continuous types of testing that have strictly defined outcomes (for example, pass/fail criteria or similar). Some types of testing — for example, user acceptance testing — can hardly be automated. However, for many other types, including database testing and integration testing, automation works wonders.

Load and performance testing examines the work of an application under different levels of load, from low to average and extremely high. It allows QA departments to prevent application shutdowns because of rapid increase in traffic, as with the HSBC mobile app we mentioned above. This type of testing falls under the automation category perfectly, because the typical QA flow with performance and load consists of numerous very similar test cases that differ only in the level of user sessions, requests, or, in our case, banking transactions. To successfully automate bank software load testing, the QA team has to:

Penetration testing is basically just another name for security testing, which means it checks how safe and solid your system is and whether it’s possible to hack it. Its importance comes from the fact that banking applications handle all kinds of sensitive information, which means there is no room for error.

The key objective of penetration testing is to discover weaknesses in the application database, as well as explore app’s reaction to unauthorized access attempts. Since the essence of penetration testing is a simulated attack, it can also be easily automated with software testing tools without compromising the accuracy of results. For banking application penetration testing, the test cases usually include the following:

Banks must undertake penetration testing for both their system and the architecture and get a formal Certificate, confirming that it has been conducted. Typically, they need to do this every 6-12 months. If they implement any fundamental changes to their software or hardware, they also need to ensure that it still complies with industry regulations.

“Full pen test isn’t a service just anyone can perform. It’s a “niche” service, which means it needs to be conducted by specific companies for banking organizations who are equipped with expertise and necessary tools.”

Bruce Mason, Delivery Director at TestFort

Regression application testing is to guarantee that the recent update or a new feature affects the existing codebase of the application. When a developer introduces a code change, even if it was intended at bug fixing, it can interfere with the work of the whole program. The codebase performance should be re-evaluated after each change, which makes regression testing a repeatable and monotonous process. That’s why we believe QA automation is very beneficial for regression testing, especially in the banking sector which has extremely high performance standards for digital products. When checking a bank app for potential regressions, we recommend paying attention to the following:

Automation in banking isn’t just about streamlining processes. First and foremost, it’s about ensuring accuracy, efficiency, and reliability that are vital in the banking industry. Here are the key advantages that automated testing brings to the table:

Overall, test automation is indispensable for banks and financial institutions looking to enhance the quality, reliability, and security of their web applications while keeping pace with the changing needs of their customers. By implementing automation testing, banks can reduce time to market for the new features and updates, improve accuracy, and deliver superior digital experiences that instill trust with their customers.

Now, while the benefits of automated software testing for banking applications are clear, implementing it into existing testing processes can be quite a challenge, especially for a newbie in the field. However, with the tips we’ll share with you, it will become much easier. So, here’s what you need to know about implementing test automation in banking effectively.

To sum it up, test automation is a powerful tool for banking organizations. By turning to automated testing, banks can easily automate 84% or more of their testing work, distributing the time saved to higher priority tasks, including testing activities that require manual testing. As a result, they can create better quality banking software that is reliable, scalable, and error-free, and takes less time to market than competitors.

Our Client Success Stories Learn more nowWhen it comes to developing effective test scenarios for banking apps, there are several types of strategies to consider. These scenarios are designed to test different aspects of the app and uncover any potential issues or bugs.

Perhaps the most straightforward type of scenario — help to ensure that the app is working as expected under normal usage conditions.

Test the app’s ability to handle unexpected or invalid inputs. Can help uncover potential vulnerabilities or error-handling issues in the app.

Test the edges or limits of the app’s functionality.

Less structured and more open-ended than other types of scenarios. They involve exploring the app in a less directed way to uncover potential issues or bugs.

By using a combination of positive, negative, boundary, and exploratory scenarios, QA teams can better identify and remediate any issues or vulnerabilities in banking apps. It’s important to keep in mind that these scenarios are not mutually exclusive and can overlap.

“In fintech QA, users reign supreme. Assess, refine, and excel – our 2023 approach to ensuring secure, compliant, and user-focused testing for top-notch financial apps.”

Michael Tomara, Lead QA Engineer

A comprehensive testing strategy should incorporate a variety of scenarios to ensure that all aspects of the app are thoroughly tested. When developing test scenarios for banking app testing, it’s important to focus on critical areas such as security, performance, regulatory compliance, and UX. Here are some examples of test scenarios for each area:

“In 2023, our QA strategy for fintech apps revolves around continuous adaptation and rigorous testing methods to ensure seamless user experiences, regulatory compliance, and unyielding protection against emerging threats in an ever-evolving digital landscape.”

Maxim Khimii, Automation QA Lead, TestFort

Finally, we’ve arrived at the most interesting stage, the stage where we’re going to discuss how to develop a testing strategy. Drawing on our 23+ years of experience, we’ve highlighted the key steps (the sequence is mostly optional) that lead to creating and implementing an efficient testing strategy no matter the project complexity. Check them out to ensure that your testing efforts are strategically aligned.

Begin by identifying the most critical scenarios to test, such as those related to security, performance, regulatory compliance, and UX. This will ensure that the highest-risk areas are thoroughly tested and that any issues are identified and remediated as early as possible in the development cycle.

Once the most critical scenarios have been identified, prioritize the scenarios that have the highest potential impact on the app and its users. For example, scenarios related to data privacy or transaction security should be given a high priority, as any issues in these areas can have severe consequences for the app and its users.

Testing scenarios should be created with the end-user in mind. By involving real users in scenario creation, you can achieve the functionality that is relevant to user needs and expectations. This can involve gathering feedback from beta testers, conducting surveys or user interviews, or analyzing user behavior data.

Manual testing can be particularly effective for scenarios related to UX or exploratory testing, while automated testing can be more effective for repetitive tasks or load testing. A combination of various testing methods ensures that all scenarios are thoroughly tested and most of the edge cases covered.

Implement a continuous testing approach by integrating testing into the development process, ensuring that new features and changes are tested as they are developed. This helps to identify and address issues early, reducing the risk of defects making it into production.

Encourage open communication and collaboration between QA and development teams to create a shared understanding of requirements and ensure that testing scenarios align with the app’s objectives. This can be achieved by using tools like JIRA for issue tracking and project management, and holding regular stand-up meetings to discuss progress and challenges.

Utilize test management tools like TestRail to efficiently manage test cases, track results, and generate reports. These tools can help streamline the testing process, making it easier for teams to stay organized, prioritize tasks, and monitor progress.

Focus on testing scenarios that pose the highest risk to the app and its users. By allocating resources and time based on the potential impact of each scenario, you can ensure that the most critical areas are thoroughly tested while optimizing the overall testing effort.

As the app evolves and user requirements change, it’s essential to review and update testing scenarios to ensure they remain relevant and effective. Conduct regular reviews of existing scenarios and make necessary updates to reflect changes in the app’s functionality, user expectations, or regulatory requirements.

Analyze production data, such as crash reports, user feedback, and app usage metrics, to identify trends and potential areas for improvement. By learning from real-world data, QA teams can refine their testing scenarios and strategies, ensuring that they continue to address the most critical aspects of the app’s performance and user experience.

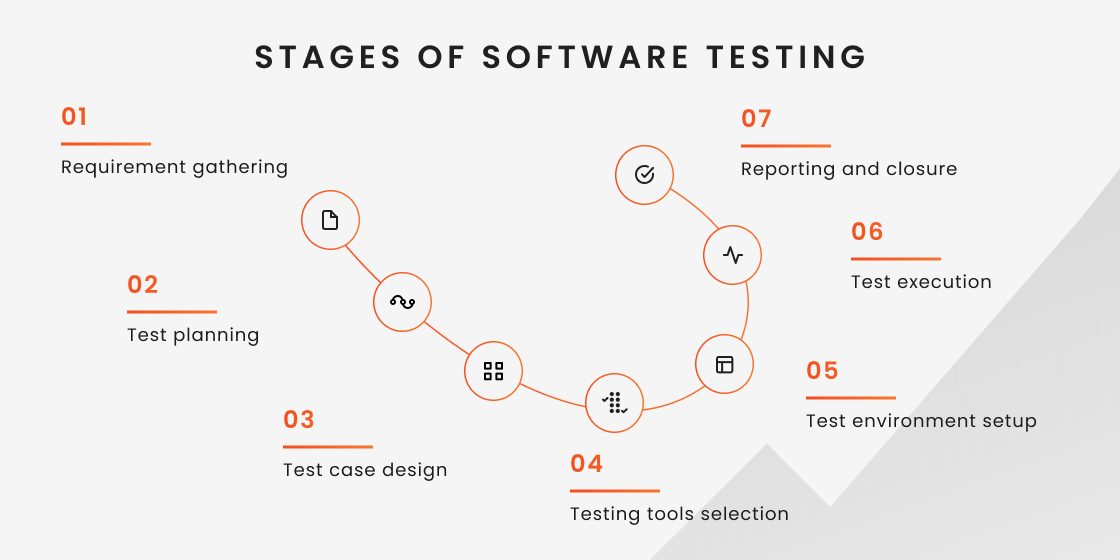

Just like the software development life cycle, banking testing is also divided into its own phases and steps to take for the team. Depending on a particular moment the QA team joins the development process, these stages might differ from one project to another. Traditionally, the software testing life cycle goes through the following phases:

That’s when the QA team communicates with product owners and stakeholders to define what they expect from the end product and how much time the team has to achieve the deliverables. We recommend organizing a few brainstorming sessions that would unite all people involved in the development, from investors to marketers. This will be useful for exchanging ideas about the future product, making sure all the colleagues operate on the same terms, and clearly understanding the desired end goal.

After analyzing the requirements, QA engineers can get to test preparation and planning. Each requirement should be reflected in the corresponding text case scenarios, for the start ― the more the better. During this phase, the QA lead develops the testing strategy that resonates with the project objectives and suits the tech stack. The testing strategy should be documented in the form of checklists and feasibility reports and agreed with the team and product owner.

After the planning phase is over, it’s time to write the actual test cases. Depending on what testing types will be present on the project, as well as manual to automated testing ratio, the amount and form of test cases can vary greatly. Detailed test cases are an integral part of quality assurance for banking applications that help the team plan the whole process correctly.

The way a QA engineer approaches the use case design will be defining for the whole software testing life cycle. If a feature or code unit is not reviewed from the right angle, the bugs can easily get into the end product. The three basic techniques of test case design include specification-based, structure-based, and experience-based. For banking applications in particular we recommend focusing on specification-based testing with pointwise use of the other two when needed. You can find plenty of sample test cases online and use them as the basis for your work.

While the tech stack of the application implies certain limitations for online-banking test teams, there are still many SaaS testing tools that support various programming languages and frameworks. In your search for software quality stack, we recommend considering testing frameworks and libraries proven by years of use. In our opinion, these include:

The Selenium suite is divided into the following components: Selenium Integrated Development Environment (IDE), Selenium Remote Control (RC), WebDriver, and Selenium Grid. For the next-gen version called Selenium 2, Selenium RC and WebDriver were combined in a single framework for an easier and faster testing process. As for 2021, the current version of the suite is called Selenium 4.0.0 Alpha 5, which was released in March 2020. It offers a seamless testing process across all web browsers that is achieved by strict W3C standardization.

Besides these, you may want to give a go to AI-powered testing tools, such as Test.ai, Functionize, Testim, Applitools, Appvance IQ, etc. that use artificial intelligence and machine learning algorithms to identify potential issues and automate testing tasks. By intelligently analyzing the app’s performance and user flows, these tools can generate a suite of test cases that cover a wide range of scenarios and ensure comprehensive test coverage.

This is when the QA team has to prepare all the configurations needed for future test cases execution. The configurations include network setup, software installation, and hardware allocation. It is important that the testing environment would match the production environment so that all the documented inaccuracies and bugs would appear the same for QA engineers and programmers.

For example, with banking software testing, it is required to study the environment (hardware capacity, operating system, web browser, Wi-Fi specification, etc.) in which the software used in this bank works at the moment, an operations management system as an example. This can serve as a good starting point for creating a testing environment for other products for this particular institution.

Test case execution is the practical phase of the software testing to implement all the plans and scenarios designed earlier. That’s when the quality assurance team finally gets to run the test cases in the environment set before and pass the results to the development team for fixing. It is important that all the divisions working on the product maintain effective communication between one another, namely the bug spotting and fixing processes should not be isolated. Development teams that seek (and take!) advice from their fellow QA colleagues deliver way higher results in terms of product quality and speed on the programming process.

Reporting is a vital part of the software testing life cycle that at times, unfortunately, gets neglected by product development teams. Clearly, nobody likes paperwork, but with software testing for banking, the accurate documentation pays back all the effort and time invested in it. With such complex software solutions as finance applications, testing documents provide solid information on everything that the product has gone through, updates, errors, and regressions included. Just from examining the QA documentation about a banking app, the R&D team can get valuable insight into the product architecture and necessary maintenance solving various “what if?” questions without risking the actual performance of a live application.

Depending on the software testing methodology, the reporting process can differ in frequency and form, however we’d recommend supporting it on a weekly basis or at least after each sprint. As for the QA test reporting banking applications, the documents also might differ from team to team as there are no strict global standards of how a bug report should look like. However, even though the contents of a bug report are considerably more important than the form of it, there are still some requirements for a report to be usable. Namely, it has to be very clear, concise, and preferably follow the listing form giving the bug reproduction instructions one by one.

3. Text overlapped in the lines.

Looking to improve your banking app? We’ll find out what your consumers want and turn it into a feature in your product Let’s talk